Acquiring art… one of the life’s great mysteries. How does one outside the ‘art world’, itself a grey and dubious term, go about buying? Didn’t I read that an embalmed shark went for $12M to Steve Cohen? You did. Numbers will numb the impulse…

Yesterday, a friend on Twitter posed these smart questions:

@borbay Can I just start making payments now for something, later, in like three years

Daniel (@dangents) May 20, 2014

@borbay do artists offer payment plans for pieces like that and if not why not??

Daniel (@dangents) May 20, 2014

I say Yes, some don’t… let’s take a closer look.

Prices Build

My first commission dates back to 1991… a pencil drawing of Beauty and the Beast which sold for $50. Through adolescence, I painted Hockey Masks for between $50-$150 a pop. The first “proper” painting transaction, a 16″X20″, went for $200 in 2003. Back then? Nobody knew who I was.

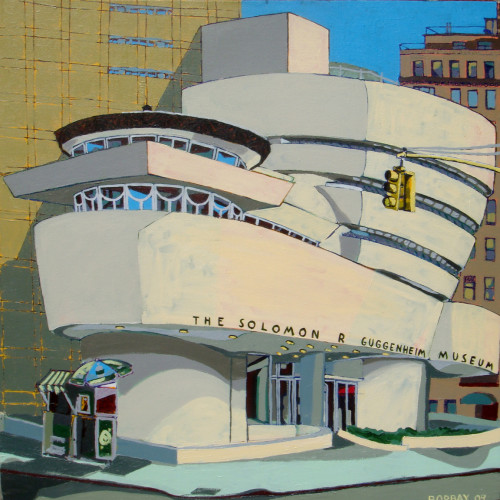

In 2009, my first Guggenheim (above), a 30″X30″ canvas sold for $2400. Then I was in Forbes and on BBC and voted Time Out’s Most Creative New Yorker. This years Guggenheim, #6 in the series, a 30″X30″, will sell for $7000. Profile and prices are on the rise…

Pricing Out

With this inherent growth, your target collector demographic shrinks. Many people can spend $2000 on a painting. Fewer will pull the trigger at $5000, and as you approach $10,000 the air becomes rarefied. According to many, and documented by few, the $8-$20,000 art market was all but obliterated in the last market collapse. The reason? This group is more inclined to buy a used Beemer for their kid to take to college than speculate on an up-and-comer.

These folks will likely sink their money is something more sure-shot, between $20-$50,000 because, who has the time to wait? As for the ultra-rich? $1.5MM at auction? Natch the foyer in your Aspen home isn’t going to decorate itself.

Basic supply and demand in a strange, unregulated marketplace. So what does this mean to someone looking to get started but feeling daunted and unsure?

Passionate Collectors Left Behind

There is a timeless tale of Van Gogh being confronted on the street by a farmer. I’ll paraphrase:

“Sir, I love that painting but could never afford it in a million years” Dude.

“Here, take it, you’ll love it more than some rich dude” Van Gogh, handing over the painting.

Heart warming, also a fine use case illustrating why artists cut off their ear and die destitute. However, the overarching message is valuable… some people love your work… and will treat it like the golden chalice. Others will use it as an investment tool looking for return. There is tremendous value in both… the key is how can you gain valuable collectors when the finances seem prohibitive?

Breaking it Down

Unsold work continues to grow in value over time. If you see an artist and think to yourself, “Damn, I can’t quite afford $5000 now, but I love the piece. I’ll just buy something in a few years.”

This is unsound logic. Provided the artists’ market does not crater, or they simply cease to create… that $5000 painting could be valued at $6000-$600,000 in a few short years. The point? If you love a piece and can swing it over time now… that’s the best move. Some artists aren’t interested in this type of structure, and that is their prerogative. I’ve done it several times, it’s been brilliant and I am always grateful to gain a collector.

Remember… as artists grow, so do those who acquire their work… just like the first buyers who sparked your career, giving collectors a chance can come full circle over time. Supernovas often arise from unexpected places (see the Scull’s).

Quarters, Thirds, Halves

Depending on the financial situation of the collector, the payment can be broken down in many ways. Some companies like to add service charges for long-term payments… I don’t. I view this type of sale as someone locking a picture down at the current market rate and paying over time. Paintings are shipping upon receipt of the final payment Shipping is added to the final payment, and the price approved in advance.

Trust

Of course, it takes trust to send several installments to someone over a period of time without receiving the goods until the final payment. This, of course, comes down to who you are doing business with and their reputation. As in art, as in anything, you are only as good as your word. Still, when I make a sale, there is always a contract… it’s a must. If a collector is unwilling to sign, that’s all I need to know.

How to Breach the Subject

Typically, if someone is interested in my work, they will request a price list. I either receive a reply with the pieces they are interested in… or not reply at all. In the case of the latter, I assume the prices were too high. In this instance, I always follow-up just to ensure my initial response didn’t find the spam filter.

But, there will always be price-out’s and more by the year. If someone loves a $6600 painting, but couldn’t dream of spending more than $1000… it wasn’t meant to be. However, should you find yourself loving a piece, but fearing the bulk sum, bring up the idea of a payment plan. It’s a nice way for artists to count on income, and it’s a fabulous way to pay something down without the one-time sticker shock. Ensure the payment terms and schedule are carefully annotated in the sales contract, and communicate frequently. Upon full payment, I am careful to share all the shipment details… this peace of mind is invaluable to the patient any collector.

Other Resources

One comment

Comments are closed.