Perhaps the most recurring question I receive from both artists and collectors is this: “how much is your work and how do you price it?”

Great question. To paraphrase Warhol: you’re at a party, and so-and-so introduces you to so-and-so, saying, “oh, I just bought a Warhol for $1000 and it’s fabulous” — this is how you establish your price.

Thus, your market begins at whatever someone is willing to pay. From there, you must maintain, protect and develop your prices.

I’ve given the pricing matter a great deal of thought over the past year. In this process, I was able to identify a void: there is no way for an artist to share their general price range without listing numbers.

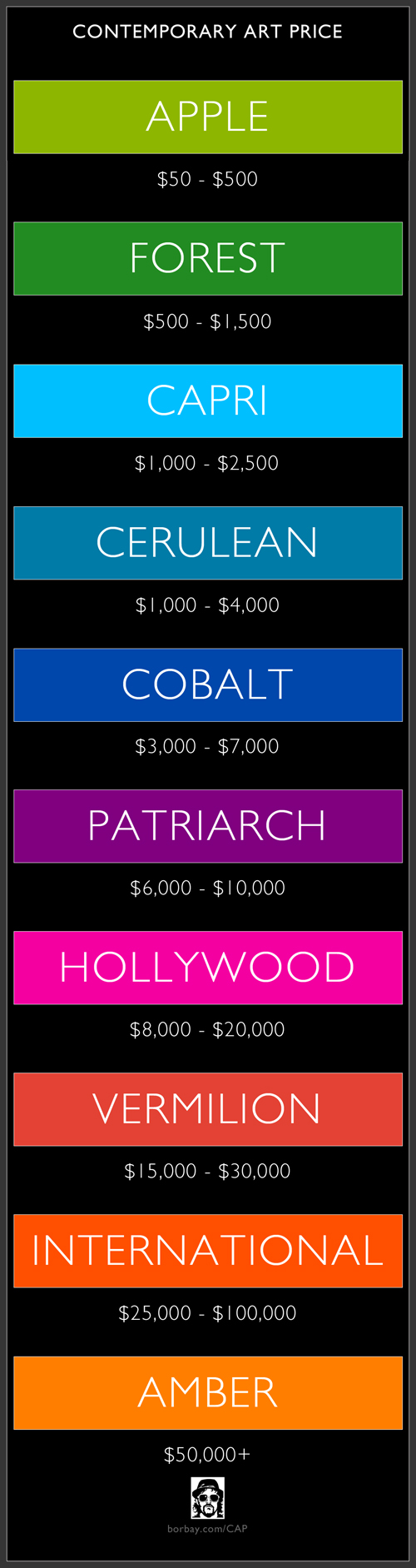

To answer the bell, I have created the “Contemporary Art Price” standard — a color coded, range-based pricing chart. After the jump, I’ll introduce the the CAP, how it can be used and share some thoughts on pricing as a whole.

Contemporary Art Pricing Chart

The figures in this chart were created based on my personal market development, conversations with fellow artists and a wide swatch of reading. Like any standardized system, it is not flawless. My direct knowledge of the upper spectrum, for example, is largely limited to what I read in the press. Additionally, as mentioned on the official CAP page, an artists price range can fluctuate depending on size, media, time to create, time period and current market.

Regardless, it will serve a purpose to anyone who decides to use it.

Utilizing the CAP Chart

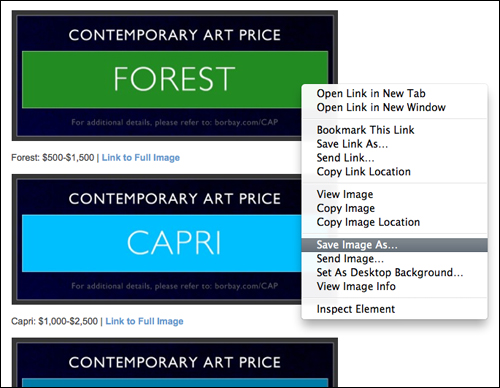

1. Download the appropriate badge from the official CAP page:

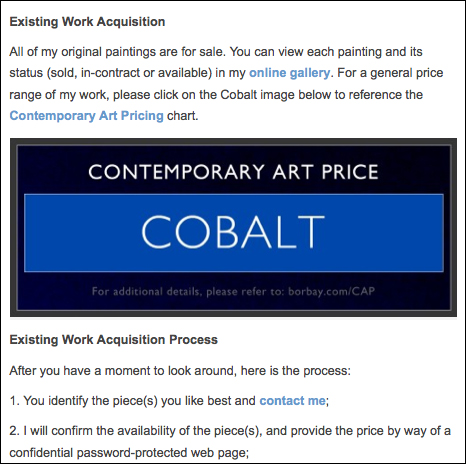

2. Upload the badge to your site (I have mine placed on my Acquisition and Commissions page) — Note: be sure to link-back to CAP:

3. From here, a collector will have a general range of your work after referencing the CAP page.

My Pricing Background

Pricing is one of the most sensitive topics for the independent artist in our digital age. A faulty approach can destroy a career before it begins. To establish my first professional sale, I was fortunate enough to know someone in the gallery industry.

When confronted with a serious collector, I emailed my gallerist friend, listing the size and media, requesting a price in-line with similar works in the market. He suggested $2400… as it happens, this price was accepted and thus my market was established.

In the 3.5 years since that initial sale, my prices for similar works go for between $5,000-$6,500. I’ve done pieces that have sold for well below this point, for example, my live painting at Broadway Bares live auctioned for $1,500 this April in Vegas… however, the picture was created in 45 minutes. On the other end of the spectrum, larger works have gone for $8,000.

All in, if you look at my sales as a whole, I fit the Cobalt range quite well.

Great Temptations

Many artists equipped with even the whiff of potential success often have a portion of their brain shut down by dancing dollar signs. This is a rookie mistake. You start thinking, “OK, solo show, 15 pieces, if I sell them all at 4 G’s a piece, I’ll walk away with 60k, and I’ll be feeling pretty pimp.”

This is wrong.

You must honor and respect your pricing market. If a majority of your work is currently selling for $1k, don’t list them at $4k because you think a show will change your life. List them at $1k and be happy to gain new collectors and red dots. Another big mistake artists make is factoring in a galleries percentage on a sale… if they take 50% (which I am against, but I’ll save that for another day) don’t simply double your price. It doesn’t work this way.

On Overpricing

Say you get contacted out of the blue by someone you know to have a great deal of money… a celebrity, high profile CEO, etc. This individual wants a quote on a piece you have priced at $5,000 — in fact, you’ve sent this price to three other people to date. Here, some people will make the grievous error of sending a $10,000 quote, because, hell, they can probably pay for it and why not cash in?

This will blow up on you in one of two ways, and the penalty may not be doled out for years. Immediate Death: this collector may be quite savvy. Say they do some investigative work and find out your pricing from several sources… if you’ve sold a bunch of work for $7-$8k, your story will check-out. However, if $5k is at the top of your market and most of your other pieces have sold for $3k, you will be immediately identified as a schemer and you will damage your name and likely lose the sale.

Slow Release Death: Say the sale goes through at $10k… awesome. However, now you are having a tough time finding collectors to pay $10k for similar works, because ones collector base tends to grow with the artist, both aesthestically and financially. So, you realize in order to pay rent, you now have to sell similar works for $3-$5k. Eventually word will reach your illustrious $10k collector, and they will not be pleased to hear they paid over double the market rate for your piece in the past. Game time.

While it is a completely unregulated industry, if you don’t price with patience and integrity, you will face the consequences on the way up, or more likely, down.

[Important to note: the picture of the Gazillionaire and artist Paul Zepeda was added for its intrinsic comedic value: Paul has a high level of integrity regarding his pricing, and I own two of his pictures.]

On Underpricing

As you grow more successful, you will find yourself contacted by burgeoning collectors with a deep passion for your work. However, they may only be able to afford $2k for a piece listed at $5k. At this point of your career, you simply cannot make the sale — it is detrimental to your existing collectors as well as your market. There are alternatives, such as a smaller commission in the same style or selling smaller works. Often the business deals that define you are the ones you walk away from.

Wrapping Things Up

There are many more facets of the pricing game to discuss, but I’ll leave it here for now. Here’s hoping you find this chart helpful, and please feel free to share, and share your thoughts in the comments below.

5 comments

Comments are closed.